China

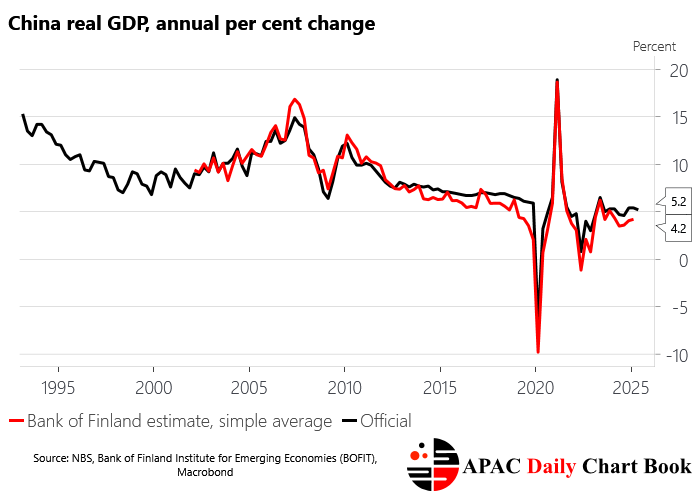

Real GDP rose 5.2% y/y in Q2, down from 5.4% y/y in Q1, but above the State Council’s 2025 growth target of 5%. Nominal GDP rose 3.9% y/y compared to 4.6% y/y in Q1, implying Q2 economy-wide price deflation of -1.3% y/y compared to -0.8% y/y in Q1. Deepening economy-wide deflation points to weak aggregate demand and monetary conditions that remain too tight. It should be noted that independent estimates of China’s real GDP growth center on 4.2% q/q as of Q1.

Industrial production rose 6.8% y/y in June compared to 5.8% y/y in May, better than financial markets expected. Output from share-holding corporations rose 6.4%, while that from SOEs underperformed at 3.9% y/y.

Fixed asset investment rose 2.8% y/y, down from 3.7% y/y in May, with private investment declining 0.6% y/y. This points to the crowding-out of more productive private firms by the SOE sector.

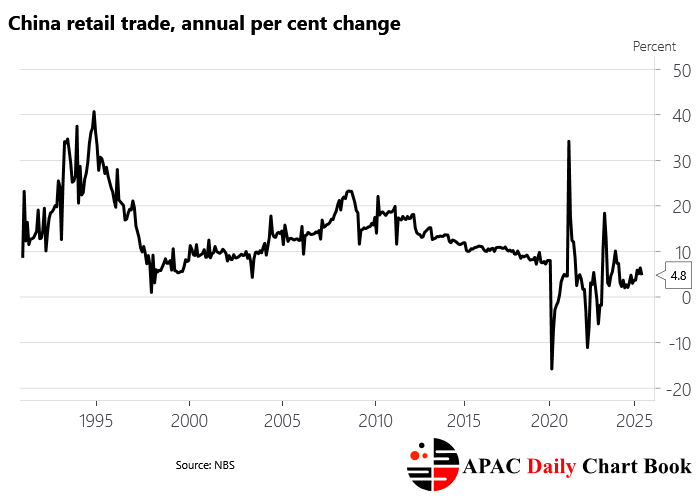

Retail trade rose 4.8% y/y in June compared to 6.4% y/y in May.

The real estate climate index deteriorated to 93.6 in May from 93.9 in April, with the sub-100 values suggesting a sector still in outright contraction.