China

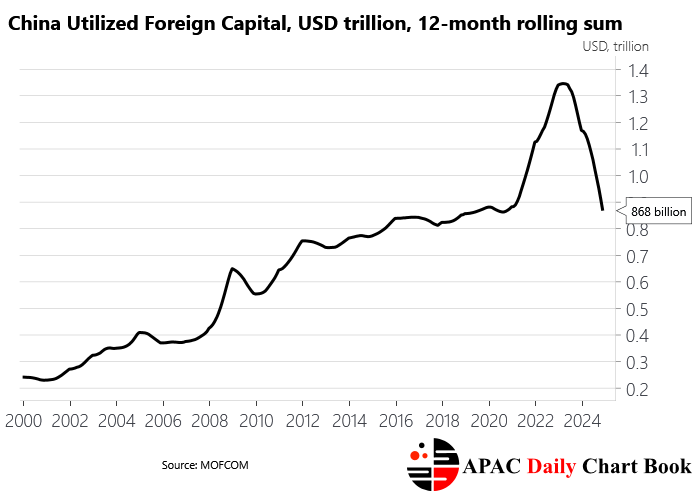

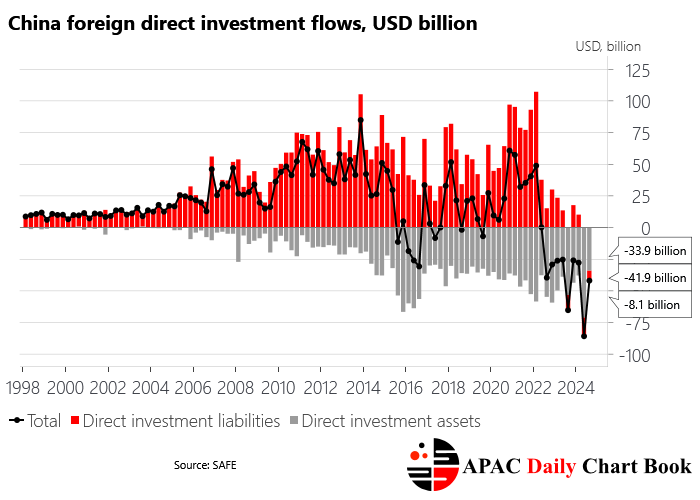

MOFCOM’s measure of foreign direct investment shows continued foreign capital flight, falling to USD 868 billion in November on a 12-month rolling sum basis from USD 910 billion in October. The SAFE measure of net FDI through to Q3 is also shown for comparison. See the piece by Nic Lardy for the differences between the MOFCOM and SAFE measures of foreign investment.

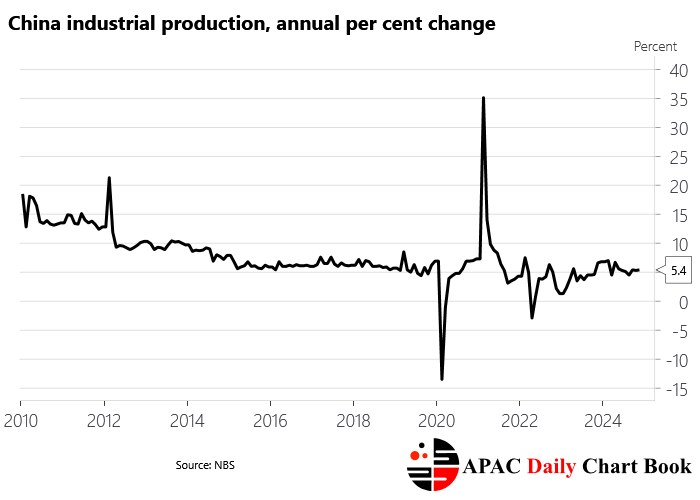

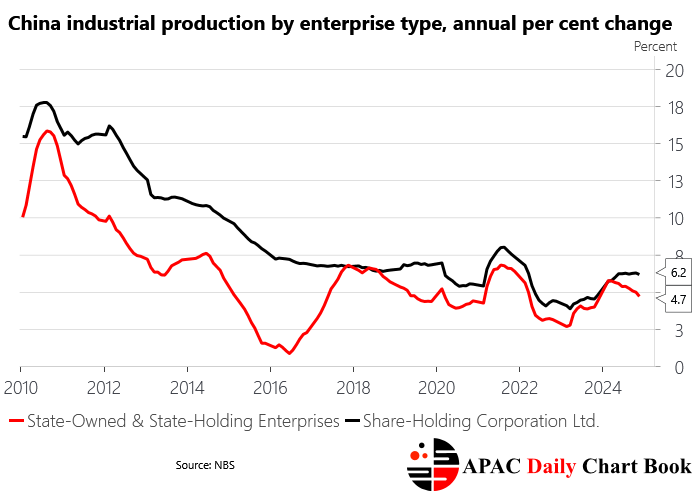

Industrial production rose 5.4% y/y in November, slightly firmer than the 5.3% y/y pace seen in October and the 5.3% pace financial markets had expected. The SOE sector continues to outperform shareholder firms, pointing to ongoing crowding-out of private sector output.

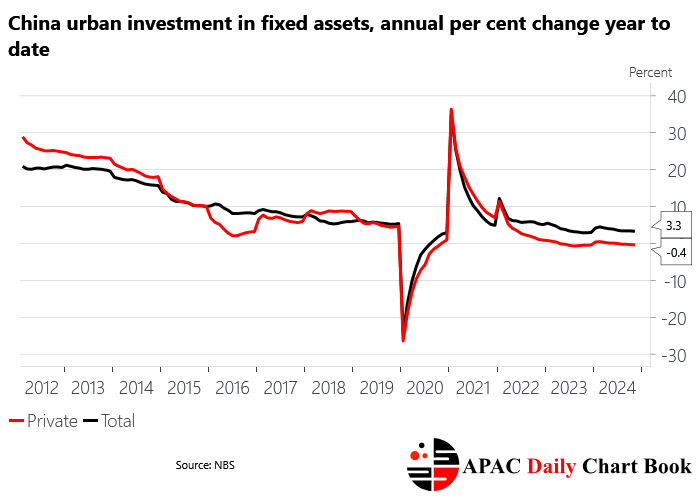

Urban fixed asset investment rose 3.3% y/y on a YTD basis, slightly weaker than the 3.4% pace seen in October, which was also the market expectation. Private investment fell 0.4%, also slightly weaker than the 0.3% y/y decline in October. It is too earlier for stimulus measures to have filtered through to realised capex, but the very flat profile for private investment points to the need for more supportive macroeconomic policy settings.

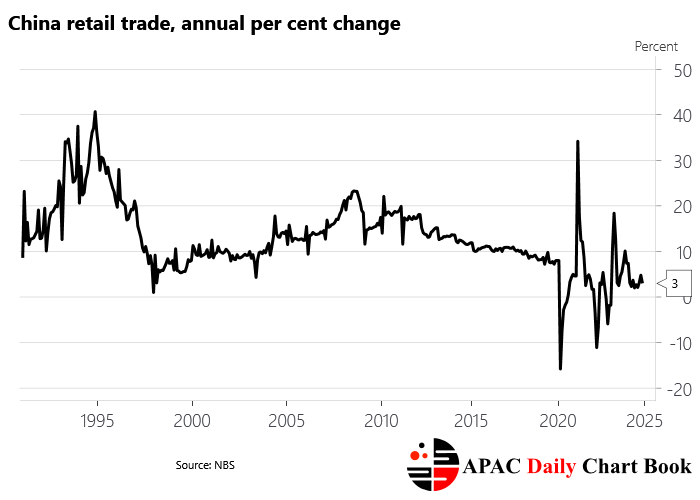

Retail trade rose 3.0% y/y in November, down from 4.8% in October and weaker than the 4.6% pace markets had expected. Retail trade is where we might expect to see some early signs of an uplift from stimulus measures announced in September and October, but it is not yet evident in this partial view of consumption.

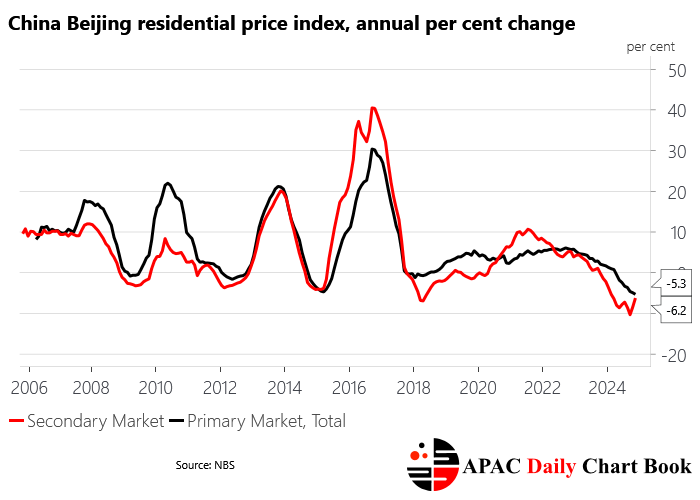

Secondary and primary market residential real estate prices in Beijing continued to decline at an annual rate, although secondary market prices moderated the pace of decline for the second consecutive month.

Japan

Keep reading with a 7-day free trial

Subscribe to APAC Daily Chart Book to keep reading this post and get 7 days of free access to the full post archives.