China

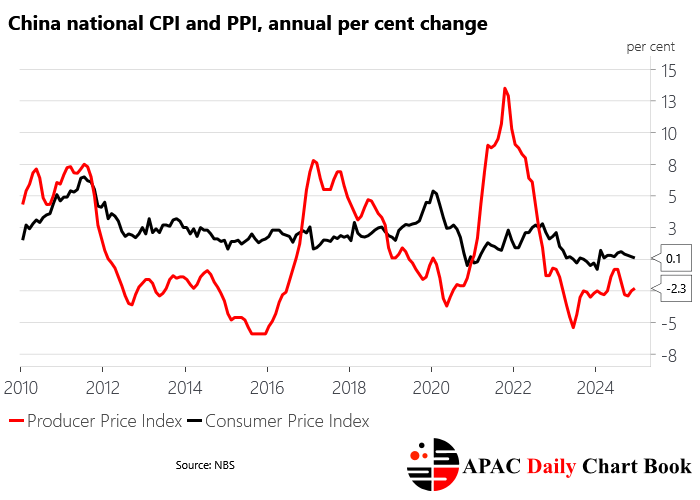

China’s CPI inflation rate closed 2024 at an annual rate of just 0.1% compared to 0.2% in November. The PPI deflated at a rate of -2.3% compared to -2.5% in November. Economy-wide price pressures as measured by the implied GDP deflator are also deflationary. Despite talk of further fiscal and monetary stimulus, aggregate demand remains weak and the authorities continue to talk of maintaining a stable exchange rate. The CNY exchange rate to the USD is at 16-month lows, trading at the lower end of the two percent daily range set by the PBoC. The 10-year bond yield continues to make new lows while YTD performance of the CSI 300 is -3.65%. China’s economy is poorly positioned going into a prospective trade war with the US, but the authorities are likely to keep their power dry until they seen the extent of US tariffs and other measures.

Keep reading with a 7-day free trial

Subscribe to APAC Daily Chart Book to keep reading this post and get 7 days of free access to the full post archives.